The options market believes there is a 15% chance that the S&P 500 will be 10% lower than its current price at year end. This marks an increase in the odds of a large stock market correction from a month ago.

The market for S&P 500 options is a large and liquid market that traders use to speculate and manage their risk. Options give traders the right to buy or sell a security at a specific price (called the strike price) upto a specific day (called the expiration date). By looking at the prices of a stocks options at a specific strike price on a specific expiration date, we can estimate the odds of a security hitting that specific price at that time.

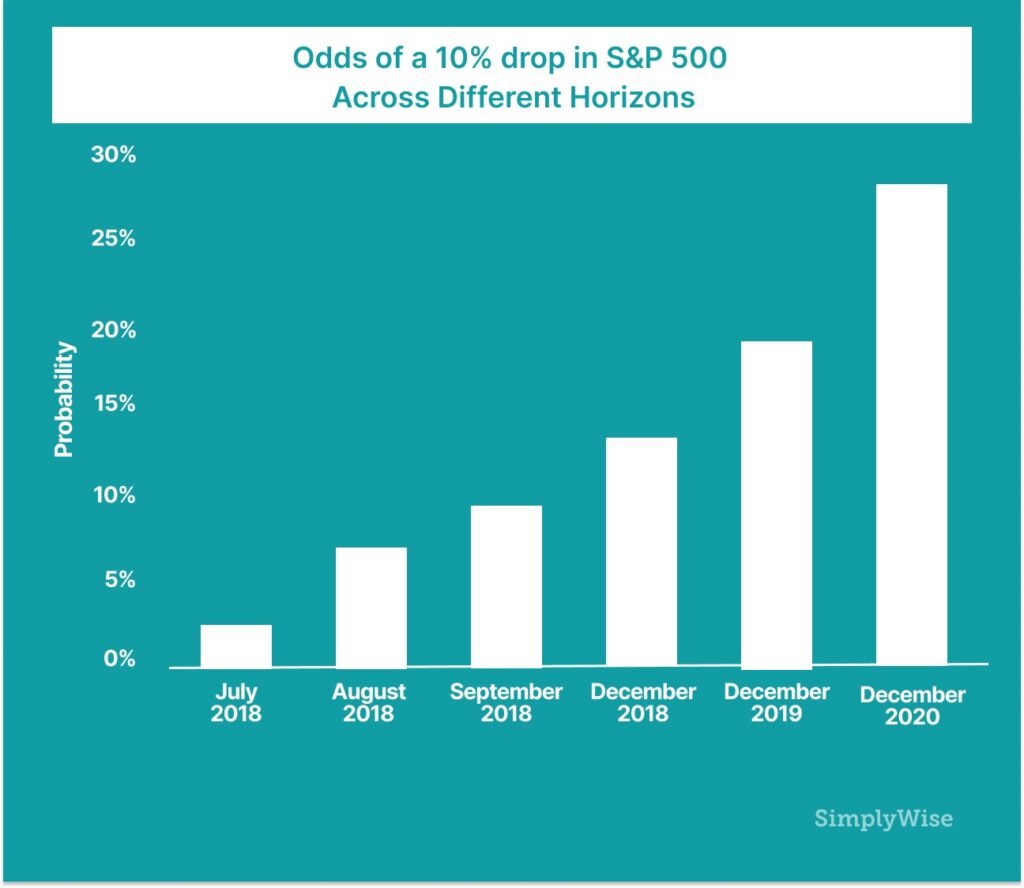

The chart below shows the odds that the S&P 500 is 10% lower than today’s price at different points in the future. The chart shows that as we move further out into the future, the odds of the market being 10% lower than today increase. By end of 2020, the options market estimates that there are 25% odds that market is 10% lower than it is today.

Which Tech Stocks Have Highest Odds of Seeing a Correction

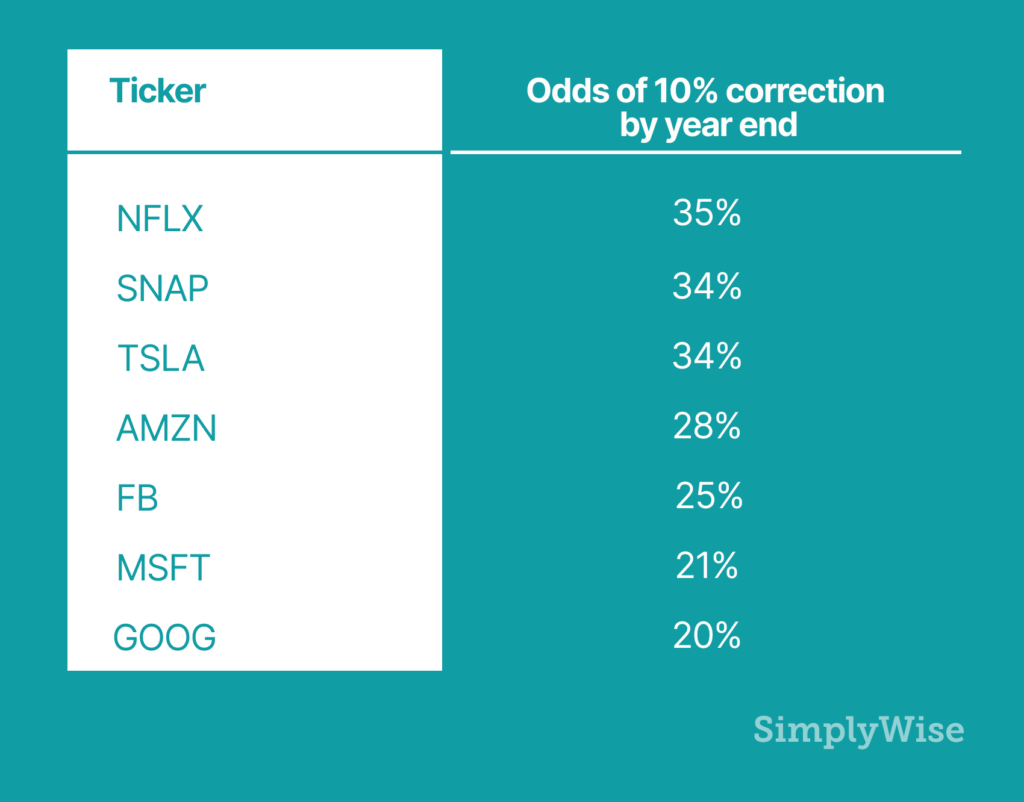

We can carry out a similar exercise on popular technology stocks to estimate the odds that they end 2018 at least 10% lower than the current price. The table is below:

The table is interesting because it shows that NFLX, after being up 120% over the past 12 months on blockbuster earnings, is now being priced by the options market to have the highest likelihood of seeing a 10% correction. TSLA, which has struggled with production delays and is down 16% over the last 12 months is also priced to have a high likelihood of seeing further steep declines. SNAP, which has returned -36% over the last 12 months is priced to have high odds of continuing it’s decline.

Ways to Protect Yourself From Stock Declines

It is very difficult, if not impossible, to predict when large stock declines will happen. The options market takes into account investors’ best guess as to the odds of specific declines in stocks and overall stock indexes. But, these odds are just estimates; it is anyone’s guess what the future holds.

Investors have generally had a few ways to protect themselves from stock market crashes. The simplest way is reduce their exposure to stocks. Another way is by increasing their exposure to fixed income instruments such as certificates of deposits (CDs) and bonds. With bond yields rising, this may be a compelling alternative. Yet another way is to purchase a fixed index annuity. This is a type of insurance contract that gives the buyer some participation in the stock market’s upside, while protecting them from any losses.

Whichever option is right for you depends on your tolerance for risk. If you are young and can afford to take risk, it may make sense to not seek protection from stock market declines. If you are nearing retirement, it may make sense to look for alternatives that protect your principal.